maine excise tax calculator

This means that depending on your location within Virginia the total tax you pay can be significantly higher than the 43 state sales tax. Sales tax is a tax that is paid to a tax authority for the sale of goods and services.

Excise Tax Information Cumberland Me

Enter your vehicle cost.

. For the excise tax deposit rules see Pub. Individuals who live in Maine and Massachusetts have until April 19 2022 to file their 2021 Form 1040 or Form 1040-SR because April 15 2022 is Emancipation Day and April 18 2022 is Patriots Day. Maine Sales Tax Calculator You can use our Maine Sales Tax Calculator to look up sales tax rates in Maine by address zip code.

Maine is an alcoholic beverage control state meaning the states Bureau of Alcoholic Beverages and Lottery Operations controls the wholesale of liquor and fortified wines within the state. Taxes are included within sale prices which means those prices are higher than they otherwise would be. In some states items like alcohol and prepared food including restaurant meals and some premade.

Extended due dates for residents of Maine and Massachusetts. Married Filing Jointly - If you are married and are filing one joint return for both you and your spouse. Other items including gasoline alcohol and cigarettes are subject to various Maine excise taxes in addition to the sales tax.

Married Filing Separately - You are married and your spouse files. 510 or the Instructions for Form. Maine Alcohol Tax.

Sales taxes can also be referred to as retail excise or privilege taxes depending on the state. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Virginia has a 43 statewide sales tax rate but also has 259 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1324 on top of the state tax.

The seller has the obligation to remit the tax to the proper tax agency within a prescribed period. - NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

Sales tax is paid by the buyer and is collected by the seller. The Maine sales tax rate is 55 as of 2022 and no local sales tax is collected in addition to the ME state tax. Your filing status determines which set of tax brackets are used to determine your income tax as well as your eligibility for a variety of tax deductions and credits.

The states excise tax on. Single - You are unmarried and have no dependants.

Maine Sales Tax On Cars Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Welcome To The City Of Bangor Maine Excise Tax Calculator

Maine Car Registration A Helpful Illustrative Guide

Maine Vehicle Sales Tax Fees Calculator

Maine Income Tax Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

Welcome To The City Of Bangor Maine Excise Tax Calculator

How To Calculate Cannabis Taxes At Your Dispensary

What Is The Gas Tax Rate Per Gallon In Your State Itep

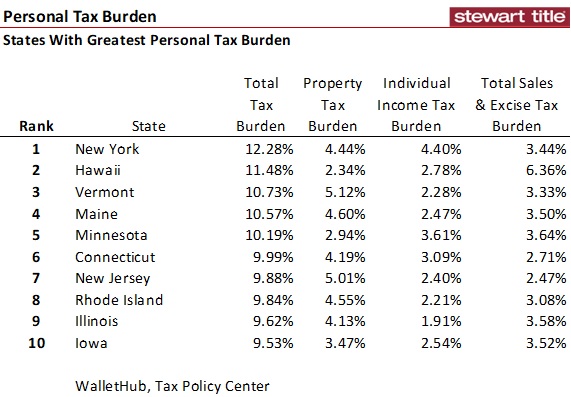

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Maine Car Registration A Helpful Illustrative Guide

Maine Who Pays 6th Edition Itep

Maine Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Welcome To The City Of Bangor Maine Excise Tax Calculator

Motor Vehicle Registration The City Of Brewer Maine